direct vs indirect cash flow forecasting

Use the four steps described in the chapter to prepare a statement of cash flows for the year ended December 31 2012 using the indirect method. The direct method only.

The direct and indirect methods of cash flow forecasting affect the cash from operating activities section of cash flows and not cash from investing activities or.

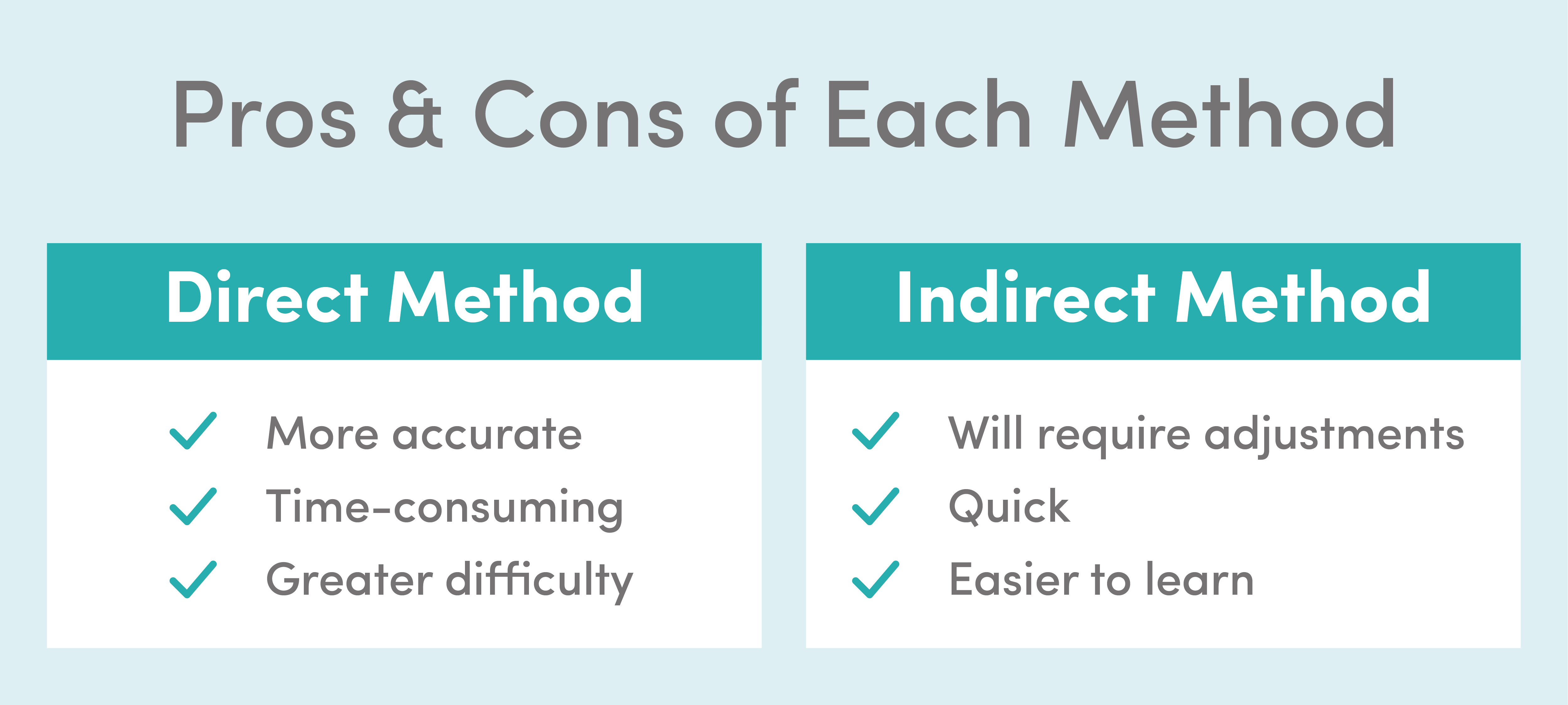

. Eventually youll need to switch to indirect cash flow forecasting as your company expands. Generally companies start with direct cash flow forecasting to understand their daily cash movements. I find the direct method despite having more rows is generally easier to understand because as you make inputs you are projecting payments or receipts money going out or coming in while with the indirect method you project changes in balance amounts.

The direct method ideal for shorter periods identifies all likely future inflows and outflows. You can perform a cash flow forecasting using either the direct or indirect method. Eventually they switch to indirect cash flow forecasting as the company expands or plans for acquisitions.

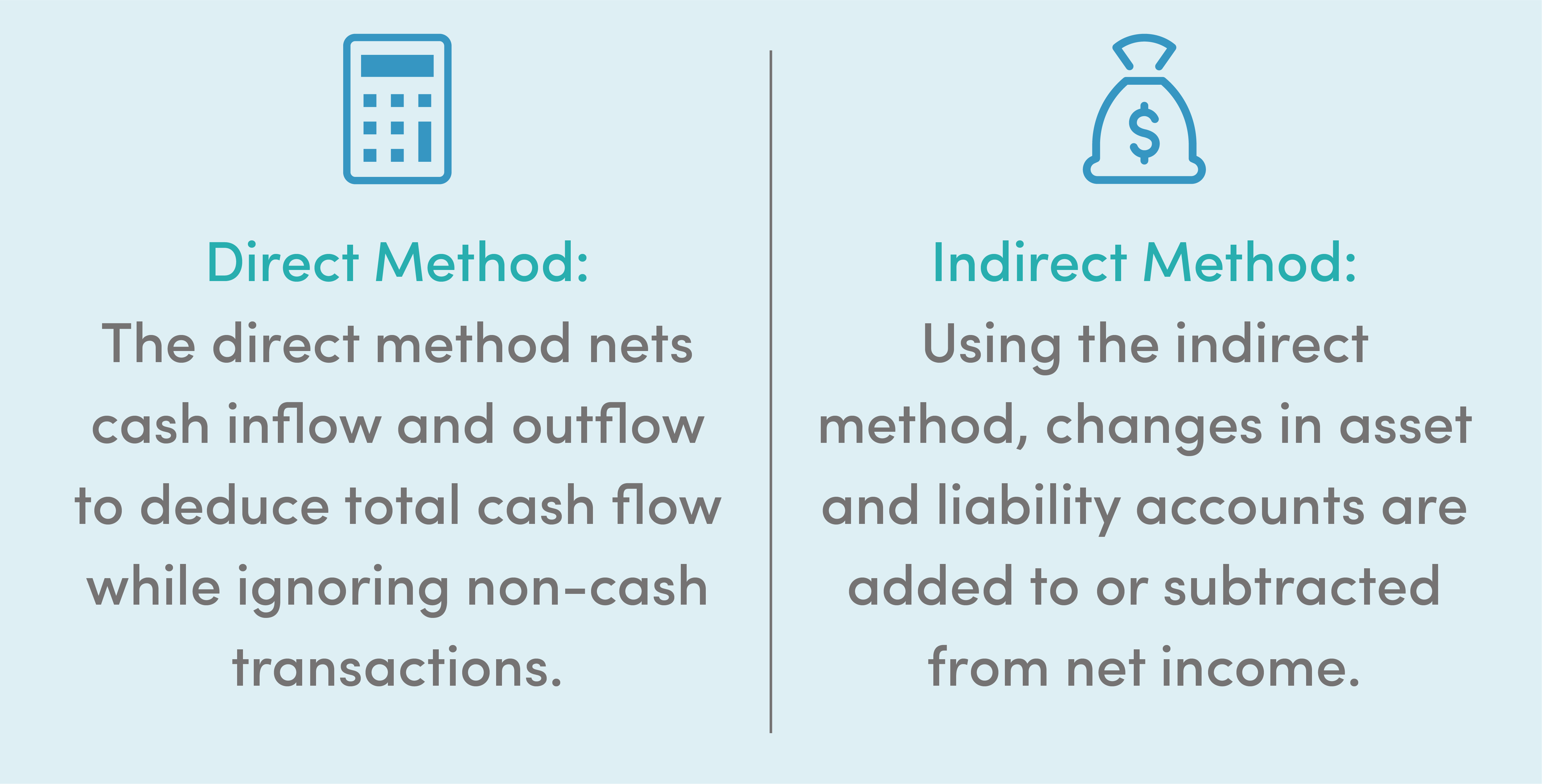

Whats the difference between indirect and direct cash flow forecasting. Moreover each business is different and may prefer a certain way. The cash flow statement makes adjustments to the information recorded on your income statement so you see your net cash flowthe precise amount of cash you have on hand for that time period.

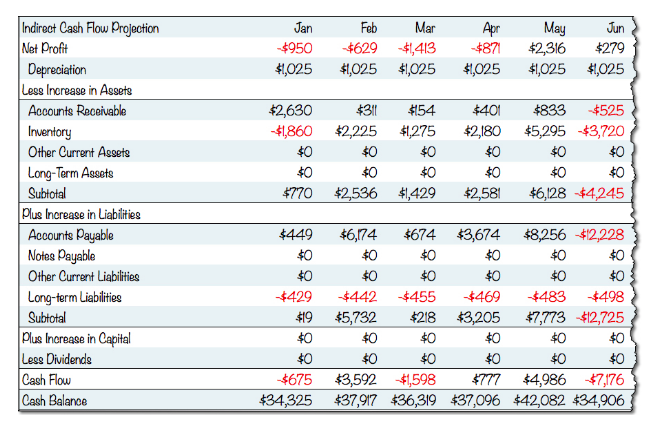

The inputs in direct cash forecasting are upcoming payments and receipts organized into units of time like day week or month. The direct and the indirect methods. Indirect cash flow method is the type of transactions used to produce a cash flow statement.

Direct forecasting can be quite accurate while indirect forecasting yields increasingly tenuous results after not. In the case of an indirect cash flow method changes in assets and liabilities accounts are adjusted in the net income to replicate cash flows from. This helps them to identify borrowing or investment opportunities.

Ad Optimize cash shore up your capital position extend your runway for business resilience. In the case of direct cash flow methods changes in cash payments are reported in cash flows from the operating activities section. Screen grabCFO Dive.

Obviously the direct method for calculating the net cash flow is not only less time consuming when comparing direct vs indirect cash flow methods but also more informative for analyzing cash flows since it makes it possible to get a more complete picture of their amount and composition allowing to determine not only the net cash flows by type of activity but also. So if the direct method is so accurate why would you use the indirect method. These units of time are then combined to the.

Ad Drive forecast accuracy and agility by connecting operational and financial models. Two main approaches exist in constructing a statement of cash flows. The indirect method which is best for longer terms uses.

Generally speaking the indirect method is easier to use. This is an essential part of measuring day-to-day cash flows and knowing whether to buyborrow investment opportunities. Whereas the direct method involves collecting information from bank transactions minusing cash income from cash expenditure to reveal your cash flow.

One of the key differences between direct cash flow vs. Either direct or indirect cash flow methods when applied correctly give the same results. Learn the differences between direct and indirect cash flow forecasting.

Alternatively the direct method begins with the cash amounts received and paid out by your business. He has been featured in an array of publications including Accounting Web Yahoo and Business2Community. Cash flow forecasting is a way to learn where a company stands in terms of its financial position by keeping track of the finances of a company and predicts where a company is heading.

The main difference between the direct method and the indirect method of preparing cash flow statements involves the cash flows from operating expenses. Under the direct method you present the cash flow from operating activities as actual cash outflows and inflows on a cash basis without beginning from net income on an accrued basis. The latter method starts from the statement of income as if it were on a cash basis.

The indirect method begins with your net income. Indirect cash flow forecasting. As a rule companies start out with direct cash flow forecasting to get an idea of daily movements.

In fact its the only feasible way of producing a cashflow forecast manually its too difficult to model any volume transactions by hand so in the past most finance people have relied on the indirect method. Indirect forecasting works instead by taking the net income and adding or subtracting categories of items to account for the difference between items calculated on an accrual basis versus the. The near-term forecasting is known as direct forecasting while the longer-term forecasting is known as indirect forecasting.

The former builds up net changes in cash flows by adding individual gross cash inflows and subtracting gross cash outflows. As a rule companies start out with direct cash flow forecasting to get an idea of daily movements. Indirect cash flow methods.

Generally there are two categories of cash flow forecasting techniques. The indirect method uses net income as the base and converts the income into the cash flow through the use of adjustments. Thats a bottoms up approach that pairs real-time data from all of the companys bank accounts with its biggest cash flow items generally its submodel.

These are called the direct and indirect method of cash flow forecasting. The main difference between the two methods relates to the cash flows from the operating activities. Because of the importance of an accurate cash picture CFOs and treasurers typically rely at least informally on whats known as direct cash flow forecasting.

Direct cash forecasting or short-term forecasting shows cash positions at a specific time. While both are ways of calculating your net cash flow from operating activities the main distinction is the starting point and types of calculations each uses. Get driver-based cash flow forecasting and scenario analysis to fit your requirements.

Up to 5 cash back 5411 Basic Concepts of the Two Methods. Here are the key differences between direct vs. These are called the direct and indirect method of cash flow forecasting.

The Direct Method Vs Indirect Method Jacob has crafted articles covering a variety of tax and finance topics including resolution strategy financial planning and more. Direct cash flow forecasting. Direct cast flow forecasting is calculated by plugging in cash inflow and outflow directly.

Create rolling forecasts with an infinite number of scenarios.

Differences Between Direct And Indirect Cash Forecasting Cashanalytics

Direct Vs Indirect Cash Flow Methods Top Key Differences To Learn

Can Quickbooks Report Cash Flows Using A Direct

Statement Of Cash Flows Cash Flow Statement Cash Flow Positive Cash Flow

The Direct And The Indirect Method For The Statement Of Cash Flows Online Accounting

Direct Vs Indirect Cash Flow Methods Top Key Differences To Learn

Preparing The Statement Of Cash Flows Using The Direct Method The Cpa Journal

Differences Between Direct And Indirect Cash Forecasting Cashanalytics

Preparing The Statement Of Cash Flows Using The Direct Method The Cpa Journal

Methods For Preparing The Statement Of Cash Flows Cash Flow Statement Cash Flow Accounting Basics

How Direct Cash Flow Models Help Predict Liquidity Wsj

Ias 7 Statement Of Cash Flow Summary Video Lecture Acca Online Accounting Teacher Positive Cash Flow Cash Flow Accounting Jobs

2022 Cfa Level I Exam Cfa Study Preparation

Free Cash Flow Statement Templates Smartsheet Cash Flow Statement Spreadsheet Template Cash Flow

Cash Flows Operating Activities Direct Vs Indirect Method Accounting Financial Tax

Printable Free Cash Flow Forecast Templates Smartsheet Cost Forecasting Template Pdf Cash Flow Budget Forecasting Personal Finance Budget